Finding an outsourced accounting service provider that fits the unique needs of your company doesn’t have to be a daunting task. A preferred ideal third-party solution will offer extensive industry experience, certified professionals and proven methods for success. Recruiting, onboarding, and managing an internal finance and accounting team takes up a significant amount of time. By partnering with an outsourced accounting services firm, business owners can free up the time they would have spent managing their accounting department to focus on running their business. Additionally, outsourced accounting firms can utilize advanced technologies that may be costly for a business to acquire independently.

How to Evaluate an Accounting Outsourcing Service

If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you. Equally, focus on finding an outsourced CFO that has significant experience navigating the challenges that are currently top of mind for your business. If your main financial goal is to sell your company, make sure you hire an outsourced CFO that has previously advised on a number of successful transactions.

Which types of outsourced accounting services are available?

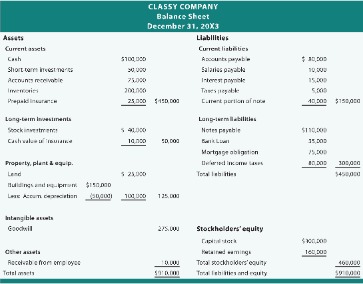

But Merritt Bookkeeping’s most stand-out feature might be its in-depth financial reports. Most other virtual bookkeeping services give you basic financial reports only, like income statements and balance sheets. In contrast, Merritt gives you more detailed reports like forecasting and quarterly comparisons.

Choosing an Outsourced Accounting Provider

Now that the cost of outsourcing is less than the pay of one financial executive, many companies are beginning to outsource their finance and accounting operations more frequently. Cutting overhead and getting better financial leadership is critical to the success of all companies. By understanding where the industry is currently and where it is moving, you’ll be able to decide whether outsourcing is the right decision for your business. Some of the top Bulgarian companies offering outsourced accounting services include NOVACON, KPMG Bulgaria, and B&Si Services. You might say that areas of accounting and bookkeeping must be done internally due to the job’s sensitivity. But with outsourced accounting, your financial statements and compliance tasks are all safe and secure, as providers are equipped to handle sensitive data and maintain work quality.

What a Bookkeeper Does for Your Business

From the hiring, onboarding, and training costs to salary and benefits to office space and equipment, you will have to spend thousands of dollars to handle your financial and accounting needs. But if you outsource the finance department, you won’t have to cover many of these costs. If you’re big enough that you’re considering a controller but not big enough to need one full-time, an outsourced controller might be the right move. Simply put, outsourcing is the action of one company hiring another company to perform its specific internal services. When you consider external accounting or bookkeeping services, you want to hire an outside service to fulfill all of your small business accounting tasks and finance responsibilities.

- Often, these third parties act almost as middlemen, helping to facilitate the sale or purchase of goods or services.

- Bookkeeper360 offers a pay-as-you-go plan that costs $125 per hour of on-demand bookkeeping support.

- As you evaluate different outsourced CFO options, there are several things to bear in mind to ensure you make the right choice.

- As businesses strive to optimize efficiency and focus on core activities, outsourcing finance and accounting functions have emerged as a viable solution.

- To choose the best overseas accounting firm, read this informative guide on offshore accounting services.

When Should You Consider Hiring External Services?

However, if there is anything in the provider’s agreement that you’re uncomfortable with, don’t hesitate to challenge it or move on to another provider. That’s why many businesses — from fledgeling startups to multinational enterprises — opt to outsource instead. 2024 is set to be a big year for accountancy, so make sure https://www.business-accounting.net/private-vs-public-accounting/ you’re ahead of the curve. Add in the potential for an international law applying to your business, and the potential for a cataclysmic error increases. Thankfully, there’s often a lengthy grace period for corporations to file everything – but that may require more knowledge about how and when to file an extention.

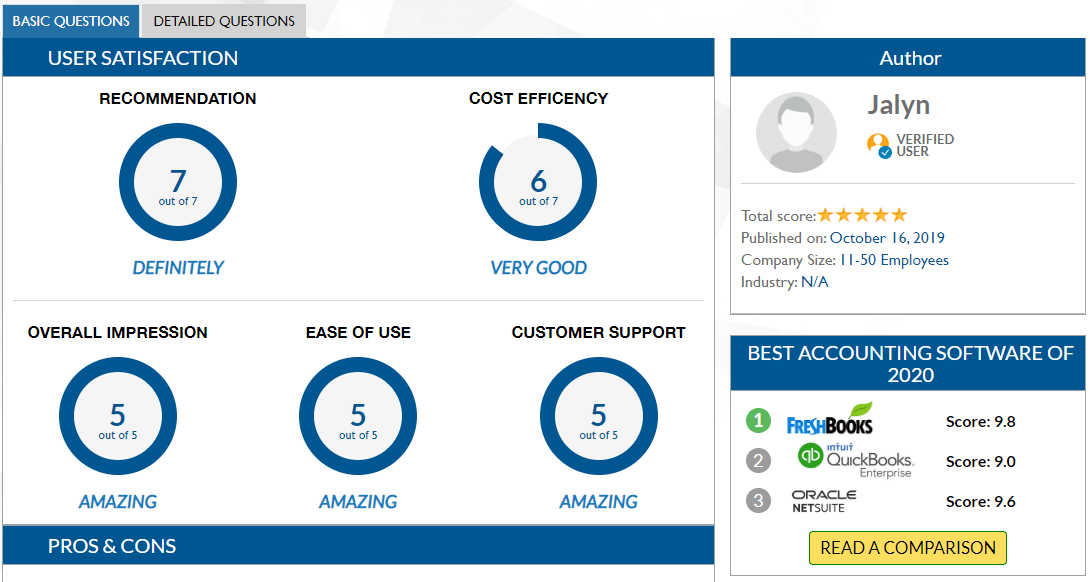

Blockchain technologies offer a huge benefit to accounting firms, with more reliable transactions and greater trust between organizations. Reports by ReportLinker and Statista both say that the value of the outsourcing industry could grow as much as $75 trillion between last year and 2027. Granted, that applies to far more than just the financial and accounting sector. Still, accounting has been projected to see a potential growth of $56.6 billion between 2020 and 2027, which is enough to confirm that this is a trend worth considering for your own operation. In accounting, it’s increasingly important to match your firm’s prices with the value that any given customer perceives you’ll provide.

You’ll be able to ensure that any dealings your clients or businesses enact can be recorded and stored on the chain. This will help you keep abreast of what’s going on, as well as make painfully slow auditing a thing of the past. For example, it will help businesses trust each other when it comes to managing transactions – there’s nowhere to hide from an unpaid invoice if it’s on the blockchain. This can be beneficial since you will have two separate firms checking the work. The disadvantage, however, is that you might have to project manage and help coordinate between them. This ensures alignment between your business goals and the services provided by the outsourcing partner.

A business owner could outsource anything from a single function such as bookkeeping to the entire department’s operation. In partial outsourcing, a company hires an external provider to support and extend the in-house capabilities. Outsourced accounting services have become a more common and practical solution for various businesses today. Be it startups, small to medium-sized businesses, or non-profit organizations, outsourcing offers major advantages. Several businesses are outsourcing accounting services to fill their company’s needs with the best knowledge and qualifications. Outsourced accounting refers to all the accounting services from an external service provider hired by a business.

You’ll boost efficiency while freeing up your staff to enjoy more interesting tasks. By taking care of the most menial jobs, automation gives you the time and headspace to focus on more pressing things, such as giving your company or third-party clients great service. With software robots picking up the slack, errors will be reduced, as staff will have more mental space to concentrate on tasks. Invoicing is traditionally thought of as an accounting function, but the ease of creating invoices in a cloud-based accounting system makes it accessible to everyone. Since invoicing usually requires greater operational knowledge than accounting knowledge, it’s typically more efficient to keep this function in-house.

In addition to the above services, our team will work closely with you to fully support your account. If needed, a highly experienced professional may also provide additional accounting and finance consulting, which is priced according to each company’s specific needs. In-house accounting involves hiring and training internal staff to handle financial tasks. Outsourced accounting relies on external experts who are already equipped to manage a businesses’ financial operations.

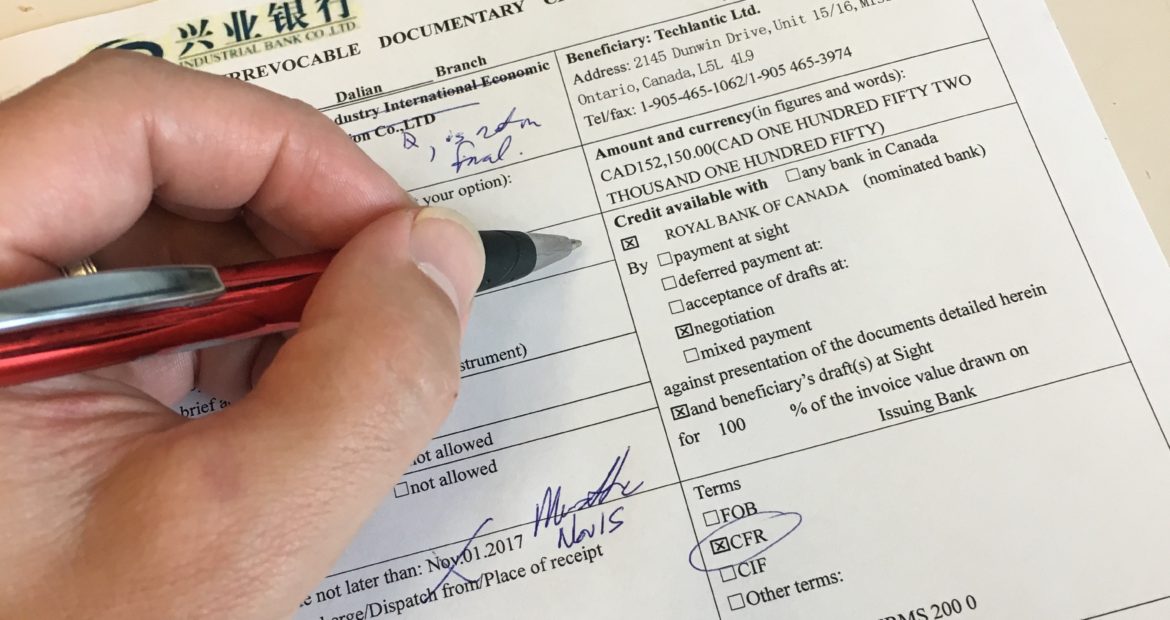

In simple terms, a third-party transaction is a sale or business transaction which involves the buyer, the seller, and another third party. Often, these third parties act almost as middlemen, helping to facilitate the sale or purchase of goods or services. However, automation projects can be pretty expensive, making them more suited to bigger real estate accounting companies. They also shouldn’t really be carried out in isolation – automation should be a project for an entire enterprise, not just a lone accountant. The four main trends our research has identified are the growth of blockchain, advancement of automation, spread of agile accounting and rise of more widespread third-party involvement.

In fact, you can outsource your entire back-office accounting function to RSM, flexibly and affordably. With Bench’s Catch Up Bookkeeping services, a Bench bookkeeper will work through past months of disorganized bookkeeping to bring your accounts up to date. These are all expenses that go into hiring an employee, and if you want to run accounting entirely in-house, it’s likely you’ll need more than one team member. If you haven’t worked with an outsourcing provider before, you might have some doubts about how well this relationship will work for your business. In years gone by, it’s fair to say that the practice of outsourcing did have some negative connotations. Access to tax and wealth advisors can assist in building an efficient financial roadmap for your business.

There’s no need to send invoicing data to an accountant when you can easily enter that data yourself. “I always mention this because it’s our concept here in D&V that an outsourced provider should be able to eliminate, standardize, and automate key processes of the client’s business. Finance encompasses the management of a company’s monetary resources, while accounting involves the systematic recording, reporting, and analysis of financial transactions.

Spurred by concerns about a fragile economy, businesses want to be sure that they aren’t overpaying. To stay clear of forensic accountants working for law enforcement or insurance companies, ensure that anyone working on accounting for your business has oversight from someone else. By establishing a system of accountability, you’ll help to nip https://www.business-accounting.net/ any potential for insider fraud in the bud. Many of the biggest accounting trends have to do with workplace flexibility and remote options. As companies grow more flexible with their employees, their accounting software must become more flexible to cope. You should use accounting AI tools to reduce the amount of time you spend on simple tasks.